NOT ALL INDEX FUNDS ARE CREATED EQUAL

Balance your holdings with the S&P 500® Index. Buy Ticker Symbol: INDEX

(TICKER SYMBOL: INDEX)

ONEFUND S&P 500®

Track the S&P 500® Index. Top 500 companies in America.

PERFORMANCE NEXT CYCLE DIVERSIFICATION STAND OUT

Market Cap vs Equal Weight

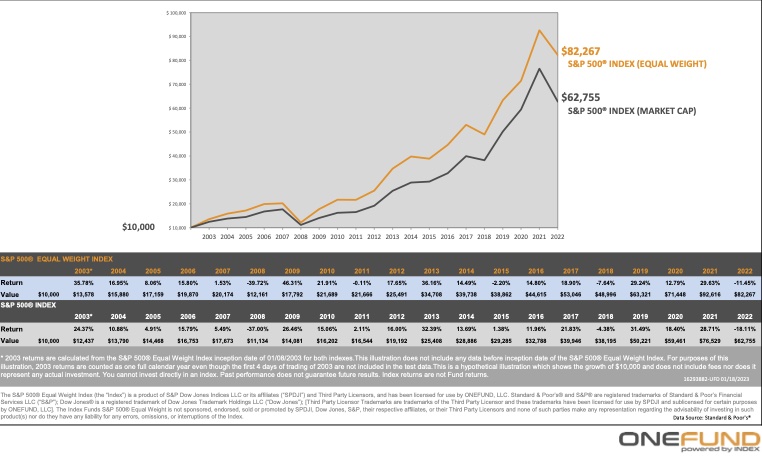

The Equal Weight version of the S&P 500® Index started trading on January 8, 2003. Since that date, it would have grown a $10,000 portfolio to $82,267 while the Market Cap version of the S&P 500 Index grew to $62,755 during the same period (as of 12/31/22, no fees considered).

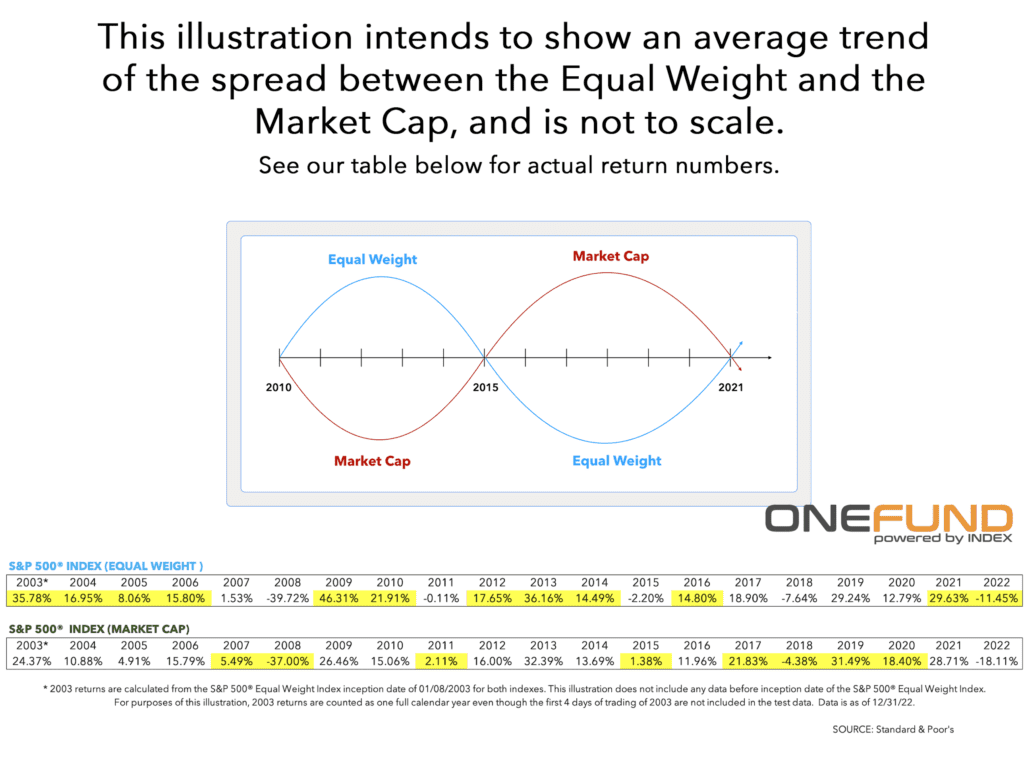

S&P 500® INDEX Cycles:

4 out of the last 5 years were won by the market cap version of the S&P 500® Index. However, the previous 5 year period was won by the equal weight version of the S&P 500® Index. YTD 2022 the equal weight is squarely back on top (as of 12/31/22).

Are we heading into a new multi-year cycle?

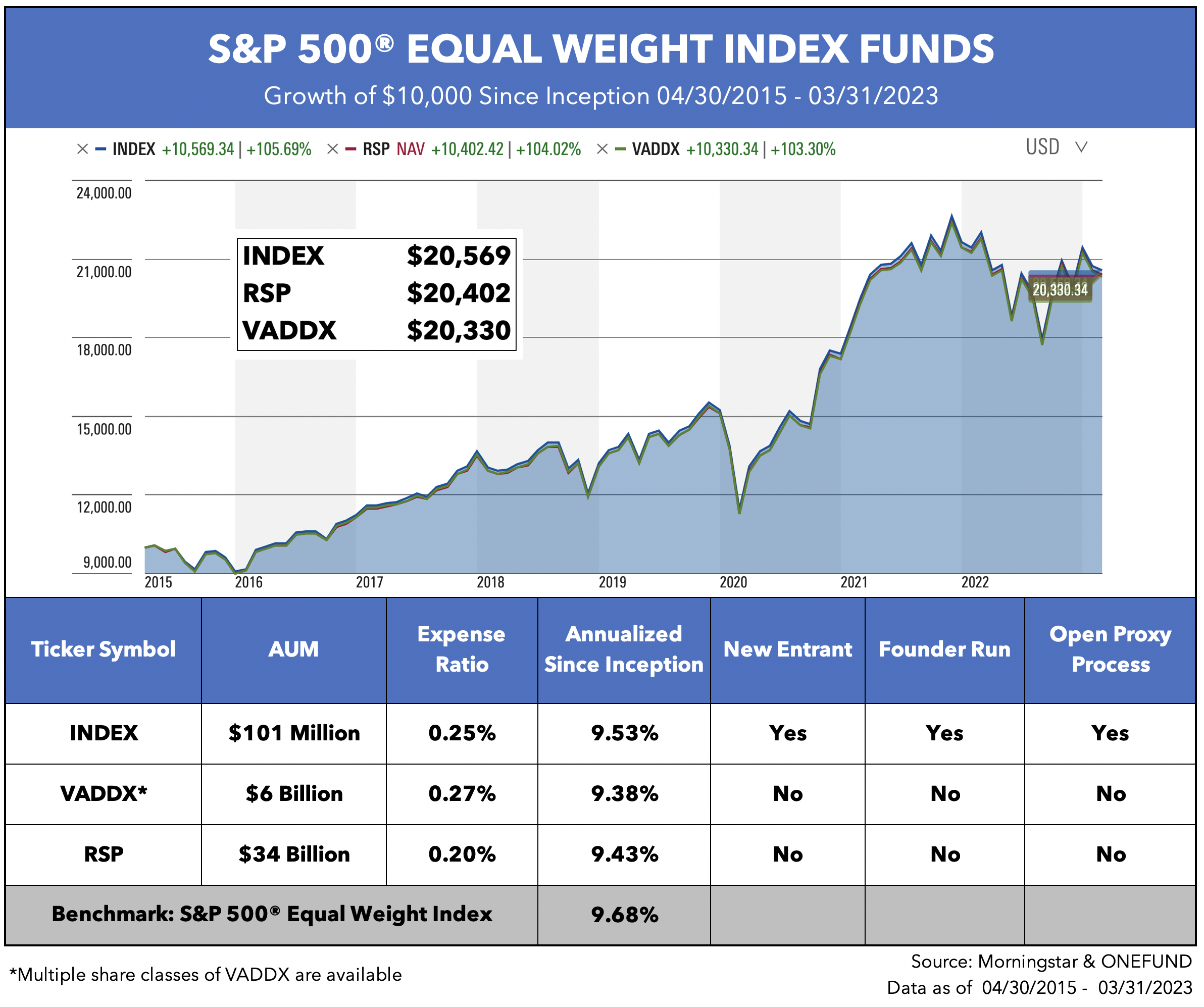

THE S&P 500® EQUAL WEIGHT INDEX FIELD

Only 3 funds track the Equal Weight version of the S&P 500® Index.

And only INDEX has an open proxy process, is founder run, and helps break the monopoly*.

*We define monopoly as the top five index fund companies owning over 90% of the index fund market.

The performance data quoted represents past performance. Current performance may be lower or higher than the performance data quoted above. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than their original cost. For performance information current to the most recent month-end, please call toll-free 1-844-464-6339.

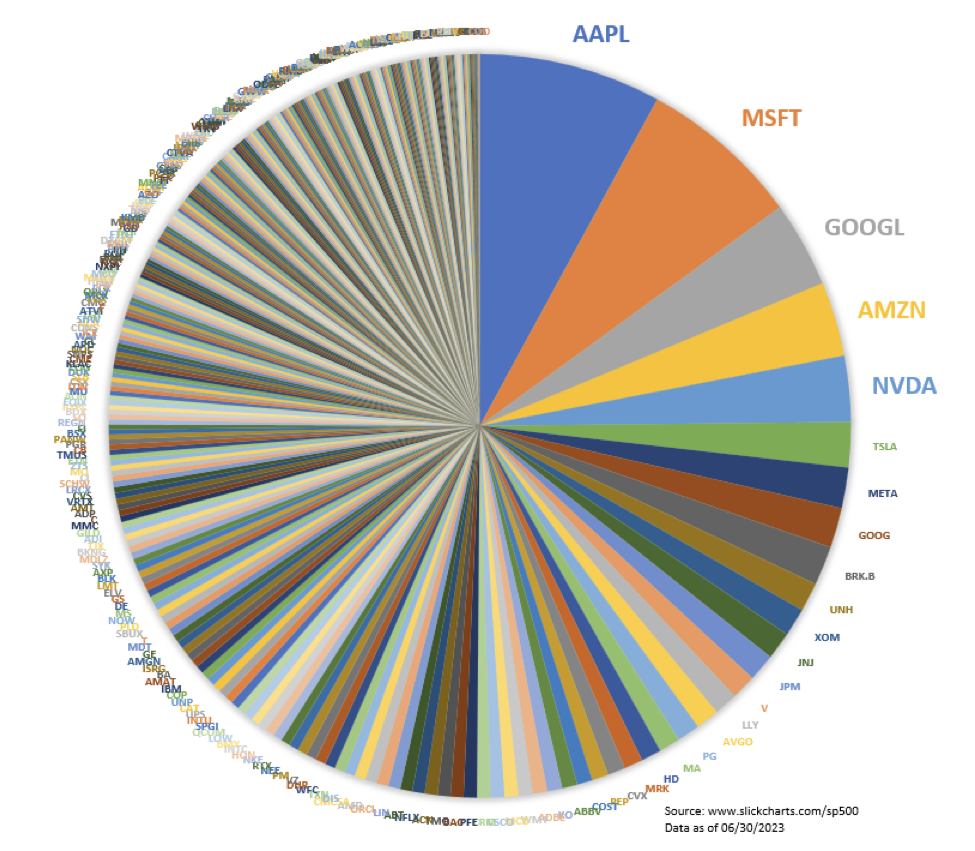

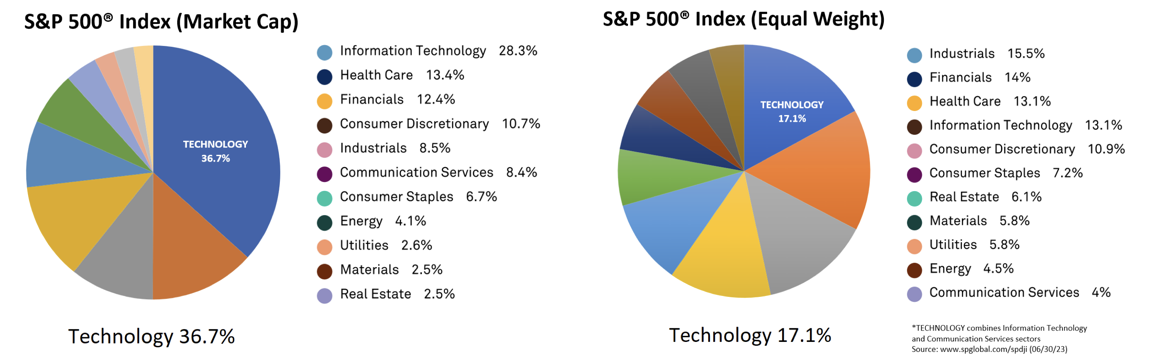

TOO MUCH TECH in your portfolio?

Tech is great but 37% may be too much volatility for some portfolios. The equal weight version of the S&P 500® Index cuts tech exposure by half.

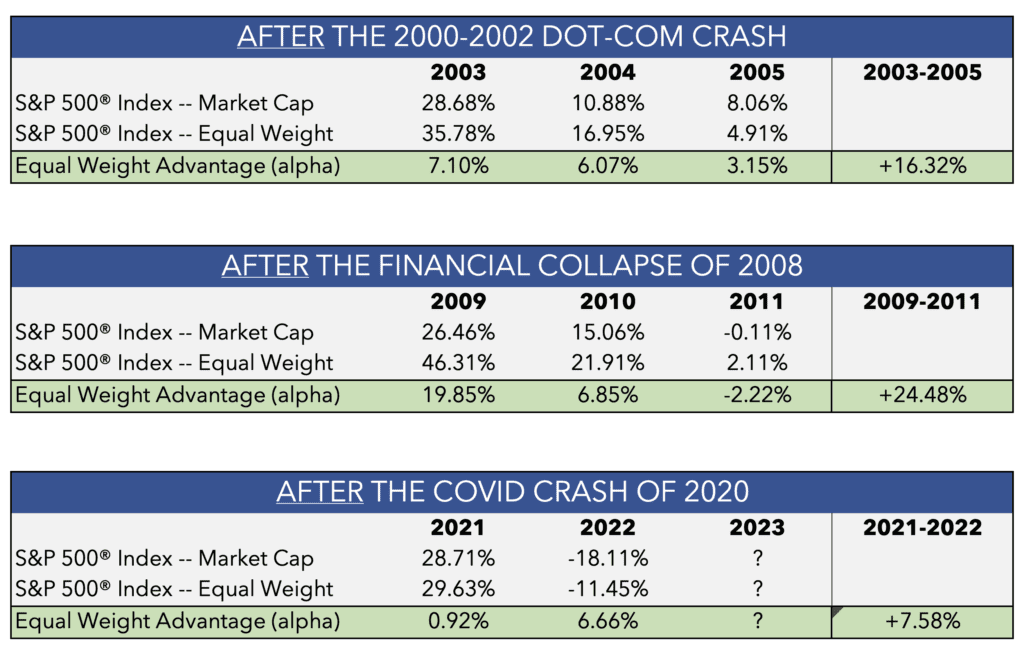

After crash ALPHA?

Directly following the last 2 major stock market crashes, the S&P 500® EQUAL WEIGHT INDEX rebounded much faster than the CAP-WEIGHTED S&P 500® INDEX.

And the ALPHA* WAS SIGNIFICANT.

+13.17% from 2003-2004

+26.70% from 2009-2010

*We define alpha as an investment strategy’s ability to beat the market.

THE INDEPENDENT ALTERNATIVE

Don't feed the giants by buying another institutional index fund.

The first S&P 500® Index Fund to open up the proxy process to our shareholders.

Bogle's Last Warning

“If historical trends continue, a handful of giant institutional investors will one day hold voting control of virtually every large U.S. corporation…Three index fund managers dominate the field with a collective 81% share of index fund assets… Such domination exists primarily because the indexing field attracts few new major entrants.”

Wall Street Journal, 11.29.18

Jack Bogle: Founder of Vanguard and the First Index Mutual Fund

the independent alternative

INDEX IS NOT OWNED BY ONE OF THE BIG THREE

“We created INDEX to give investors a way to break this monopoly.”

Michael Willis, Co-Founder of ONEFUND

decentralize proxy voting

a landmark announcement

The more we researched, the more the answer became obvious to us. Why not ask our investors to weigh in? America is a democracy after all, why not here? Introducing – INDEX VOTING CHOICE.

Through our partnership with iconik, shareholders can create their own customized voting profiles or choose one of the preset voting profiles below:

- As You Vote ESG+

- Conservative

- Catholic Values

- Shareholder Protections

- Board-aligned

Index Voting Choice Disclaimer

Proxy Voting allows voters to vote their shares without attending the meeting. Proxy Polling is where we poll our shareholders for their opinions and factor your input before voting your shares. There is no guarantee the Fund Manager will follow the shareholder proxy polling in their final decision.